What is the New Securities Markets Code Bill, 2025?

Synopsis

Key Takeaways

- Consolidation of three securities laws.

- Enhanced investor protection measures.

- Streamlined regulatory procedures.

- Introduction of a Regulatory Sandbox.

- Decriminalisation of minor infractions.

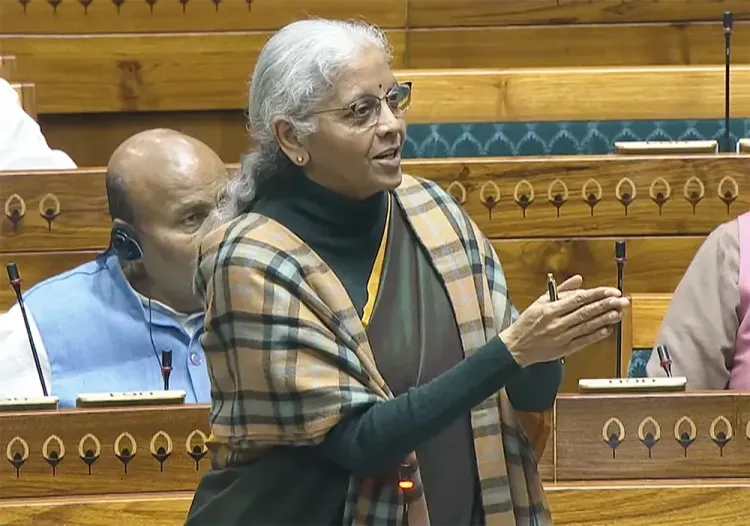

New Delhi, Dec 18 (NationPress) Finance Minister Nirmala Sitharaman presented the Securities Markets Code Bill, 2025, in the Lok Sabha on Thursday. This legislation aims to consolidate, rationalise, and replace the three current securities laws—the SEBI Act of 1992, the Depositories Act of 1996, and the Securities Contracts (Regulation) Act of 1956—into a single law.

The purpose of this Bill is to establish a contemporary legal framework for investor protection and capital mobilisation. It encourages a participatory approach and consultative regulation, fostering greater awareness and attracting new participants.

The introduction of the Securities Markets Code 2025 marks a significant milestone; this comprehensive review of securities markets is unprecedented and is designed to enhance access for investors while boosting capital mobilisation to meet the demands of India’s rapidly expanding economy, as stated by officials.

The current regime of securities law consists of three legislations that were enacted decades ago, leading to numerous overlapping and redundant provisions. Consequently, the government has opted to merge these Acts into a Single Securities Markets Code (SMC). This initiative aims to create a principle-driven legislative framework that minimizes compliance burdens, enhances regulatory governance, and promotes the dynamism of technology-driven securities markets, thereby facilitating easier business operations.

The language of the Code has been simplified, eliminating redundant concepts and duplications while establishing consistent regulatory procedures to assure a uniform and streamlined framework for securities laws.

This Code also intends to fortify the regulatory mechanism of SEBI by expanding its board to 15 members (up from the current 9, including the Chairperson) and instituting a transparent and consultative process for issuing subordinate legislation.

Additionally, it seeks to eliminate conflicts of interest by mandating board members to disclose any 'direct or indirect' interests in decision-making.

Moreover, the Code optimizes the enforcement procedure, ensuring that all quasi-judicial actions are conducted through a unified adjudication process following an appropriate fact-finding mission. It maintains a clear separation between the fact-finding processes, such as inspections or investigations, and adjudication proceedings. The Code also sets timelines for investigations and interim orders, ensuring a timely completion of enforcement actions, thus providing clarity and certainty to market participants.

In a major progressive move, the Code decriminalises the omnibus criminal provisions and certain minor procedural and technical violations, replacing them with civil penalties, thus easing the burden of compliance. Criminal offences are now limited to only (i) market abuse, (ii) non-compliance with quasi-judicial orders, and (iii) non-cooperation during investigations.

Furthermore, the Code aims to bolster investor protection, enhance investor education and awareness, and ensure prompt and effective redressal of investor grievances. It also establishes an Ombudsperson mechanism for grievance redressal.

Additionally, the SEBI is enabled to create a Regulatory Sandbox to promote innovation in financial products, contracts, and services. An enabling framework for inter-regulatory coordination of other regulated instruments is also established to ensure a smooth process for listing such instruments.

In summary, the Bill aims to establish a legal framework that significantly strengthens the Securities and Exchange Board of India, enhances securities markets' efficiency, improves regulatory governance, and fortifies investor protection.