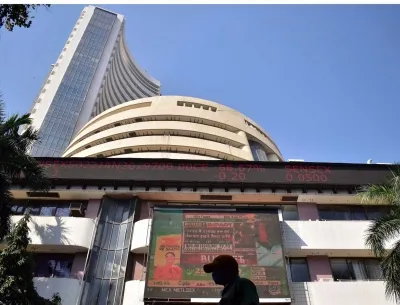

Why Did Sensex and Nifty Close Lower on Friday?

Synopsis

Key Takeaways

- Sensex dropped 466.75 points, closing at 83,938.71.

- Nifty fell 155.75 points, ending at 25,722.10.

- Majority of sectors faced selling pressure.

- Investors cautious due to weak global cues.

- ‘Buy on dips’ strategy remains favorable.

Mumbai, Oct 31 (NationPress) The benchmark Indian equity indices experienced a downturn on Friday, signaling a lackluster end to the week as selling pressure affected a majority of sectors.

The Sensex dropped 466.75 points, or 0.55 per cent, closing at 83,938.71, while the Nifty fell 155.75 points, or 0.60 per cent, to finish at 25,722.10.

“The price action indicates that while bulls have momentarily lost steam, the overall structure remains sound as long as Nifty holds above 25,660,” analysts remarked.

“A definitive close beneath this threshold could lead to further declines toward 25,400–25,250. Conversely, a rebound and sustained movement above 26,000 may reestablish bullish trends, paving the way toward 26,150–26,300,” they noted.

Losses were widespread, with most Sensex stocks finishing lower. Only a few heavyweights, including BEL, Larsen & Toubro, TCS, ITC, and State Bank of India, managed to stay in the green.

In contrast, major laggards such as NTPC, Kotak Mahindra Bank, Bajaj Finserv, ICICI Bank, and HDFC Bank fell sharply, with some losing up to 3.45 per cent.

The broader markets also reflected this weakness. The Nifty Midcap 100 index decreased by 0.45 per cent, while the Nifty Smallcap 100 saw a decline of 0.48 per cent.

Among sectoral indices, only Nifty PSU Bank and Nifty Oil & Gas recorded gains of 1.5 per cent and 0.07 per cent, respectively.

All other sectors closed in the negative, with Nifty Metal and Nifty Media emerging as the poorest performers, each plummeting over 1 per cent.

Analysts pointed out that investor caution was prevalent due to weak global cues and profit-booking ahead of the weekend, leading to a broad-based market decline.

“Indian equities concluded significantly lower after a volatile trading session, as investors took profits amid mixed corporate earnings and a cautious global environment, especially with a strong dollar,” market observers noted.

“Most sectors closed negatively, impacted by renewed FII selling, which has become cautious following Powell’s hawkish remarks, along with disappointing US-China trade developments,” they added.

Experts anticipate that the strategy of buying on dips will remain prevalent, as optimism continues to build on a quarter-over-quarter basis.