Did the Taxable Value of Goods Really Surge by 15% in September-October Due to GST Cuts?

Synopsis

Key Takeaways

- 15% surge in taxable value under GST during Sept-Oct.

- Tax cuts triggered a marked increase in consumer spending.

- Strong growth observed in sectors like FMCG and pharmaceuticals.

- Next-gen GST reforms have maintained revenue stability.

- Taxable value serves as a reliable indicator of economic trends.

New Delhi, Dec 1 (NationPress) The taxable value of all supplies under GST has jumped by an impressive 15 percent during the months of September and October this year, compared to the same timeframe in 2024. This surge is attributed to a significant increase in consumption spurred by tax rate reductions on various goods that were implemented from September 22, as per official sources.

The growth observed during the same two-month period last year stood at 8.6 percent.

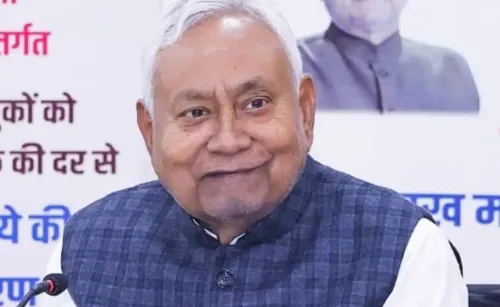

“This remarkable increase in taxable value during 'Bachat Utsav' is a clear indication of strong consumer demand, fueled by lower tax rates and enhanced compliance,” stated a senior official.

The official noted that the growth has been particularly pronounced in sectors that benefitted from rate rationalization, such as FMCG, pharmaceuticals, food items, automobiles, medical devices, and textiles.

In these sectors, the taxable value of supplies has witnessed considerably higher growth, affirming that reduced GST rates have directly led to increased consumer spending.

“This validates our approach that lowering rates on essential and widely-used goods would stimulate demand—a Laffer Curve-type demand surge,” the official elaborated.

These developments affirm that the next-generation GST reforms have not undermined revenue stability and that the rise in consumption has begun to reflect in increased taxable values across key sectors.

This growth is measured in value terms, indicating that with lower GST rates, the increase in volume terms will likely be even more pronounced.

Clearly, while the Next Gen Reforms have resulted in substantial Bachat—enhanced consumption—industry players have actively passed the benefits of GST savings to consumers, ensuring no supply-side deficiencies.

As private consumption data for GDP will be published later, the taxable value under GST serves as a timely and reliable indicator of consumption trends, with current figures suggesting a consistent demand expansion,” the official added.