How is NSIC Partnering with Private Banks to Improve MSME Credit Access?

Synopsis

Key Takeaways

- NSIC collaborates with banks to enhance credit access for MSMEs.

- MOUs signed with key private sector banks.

- Focus on making credit more accessible and affordable.

- Supports the government's 'Vocal for Local' initiative.

- Pradhan Mantri MUDRA Yojana facilitates loans for local enterprises.

Mumbai, Aug 14 (NationPress) The National Small Industries Corporation (NSIC), a government Public Sector Undertaking (PSU), has entered into Memorandums of Understanding (MOUs) with multiple private banks to improve credit availability for Micro, Small, and Medium Enterprises (MSMEs) under its MSME Credit facilitation scheme, as stated in an official announcement.

The objective of these MOUs is to enhance both the accessibility and affordability of credit for MSMEs, as highlighted in the release.

The agreements were finalized with banks such as Axis Bank, Dhanlaxmi Bank, Karnataka Bank, AU Small Finance Bank, and IndusInd Bank, according to the official statement.

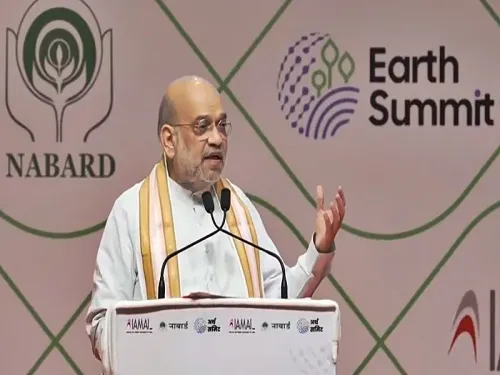

Present at the signing ceremony were Union MSME Minister Jitan Ram Manjhi and MSME Secretary S.C.L. Das. The MOUs were exchanged between NSIC's Director of Finance, Gaurav Gulati, and senior representatives from the participating banks.

This collaboration is designed to provide comprehensive support to MSMEs and facilitate their integration into the formal financial ecosystem. The focus of the MOUs is to encourage banks to broaden their outreach to deserving micro and small enterprises, thereby acting as a catalyst for banks to connect with the last mile.

This initiative aligns with Prime Minister Narendra Modi's recent promotion of the ‘Vocal for Local’ campaign, urging individuals and businesses to support locally-produced goods instead of imports, which aims to bolster domestic manufacturing, create jobs, and stimulate the local economy.

Since its launch, the Pradhan Mantri MUDRA Yojana (PMMY) has approved an impressive 53.85 crore loans, totaling over Rs 35.13 lakh crore. The PMMY provides collateral-free loans of up to Rs 20 lakh to micro and small enterprises, facilitating self-employment and income generation.

More than 10 lakh micro and small enterprises (MSEs) have registered on the Government e-Marketplace (GeM) portal, with the total transaction value on GeM reaching approximately Rs 5.40 lakh crore in FY2024-25.

Established in 1955, the NSIC, under the MSME Ministry, has been dedicated to promoting, supporting, and nurturing the growth of MSMEs in India, consistently pioneering new initiatives to address their challenges through various schemes.