How Did Punjab Achieve Record Growth in GST Collections?

Synopsis

Key Takeaways

- 44.44% growth in GST collections for June 2025.

- First quarter growth of 27.01% for this fiscal year.

- Net GST collection for June stood at Rs 2,379.90 crore.

- Punjab outperformed the national average in GST growth.

- AAP government's effective policies contributed to this growth.

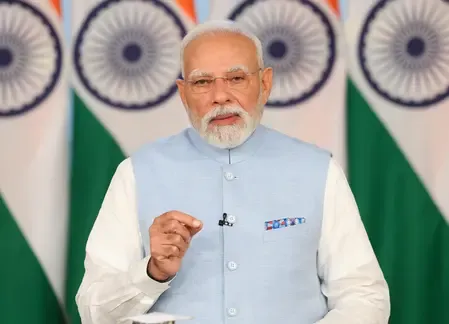

Chandigarh, July 1 (NationPress) Punjab has experienced an astonishing 44.44% increase in net Goods and Services Tax (GST) collections for June 2025, alongside a remarkable 27.01% growth for the first quarter of this fiscal year, setting new records for the state, reported Finance Minister Harpal Singh Cheema on Tuesday.

Following the recognition of the top five taxpayers for their vital role in boosting the state’s economic progression and revenue generation, Cheema noted that Punjab has surpassed the national average in GST growth. This achievement firmly establishes the state as a leader in tax mobilization, despite facing various national and geopolitical challenges, including tensions at the border.

The net GST collection for June amounted to Rs 2,379.90 crore, marking a significant revenue increase of Rs 732.21 crore from the Rs 1,647.69 crore collected in June 2024. This growth follows previous monthly trends of 15.35% in April and 24.59% in May.

For the first quarter of 2025-26, the net GST collection reached Rs 6,830.40 crore, even amidst the ongoing conflict between India and Pakistan in May, compared to Rs 5,377.75 crore in the same quarter of 2024-25.

"This indicates a growth rate that is over four times the 6.41% growth rate recorded in the first quarter of 2024-25," Cheema stated while criticizing the previous governments led by SAD-BJP and Congress for their inability to curb tax evasion and enhance fiscal health.

He emphasized that the AAP government has maintained consistent growth both month-on-month and year-on-year.

Over the past three years, GST collection growth rates were 16.25% in 2022-23, 15.51% in 2023-24, and 12.84% in 2024-25, totaling Rs 62,733 crore. In contrast, during the Congress regime from 2018-19 to 2021-22, the state’s total collection was merely Rs 55,146 crore. Additionally, during the SAD-BJP tenure, growth in Value Added Tax (VAT) and Central Sales Tax (CST) was only 4.57% and 2.67% in the fiscal years 2014-15 and 2015-16, respectively.

"The AAP government has already amassed more revenue in three years than what the Congress government achieved in its entire five-year term," Cheema concluded.