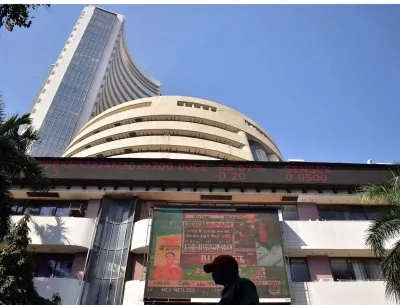

Did BSE Achieve a 364% Surge in Profits and Announce a Rs 23 Dividend per Share?

Synopsis

Key Takeaways

- BSE experienced a 364% profit increase in Q4 FY25.

- Declared a total dividend of Rs 23 per share.

- Includes a special dividend to celebrate the 150th anniversary.

- Revenue from core operations grew by 75%.

- BSE shares delivered over 4,785% return over five years.

Mumbai, May 6 (NationPress) The Bombay Stock Exchange (BSE) reported an extraordinary 364% increase in profits, reaching Rs 493.04 crore for the January to March quarter of the financial year 2024-25 (Q4 FY25), a significant rise from Rs 106.16 crore during the same quarter last year.

In addition, the BSE experienced a substantial growth in revenue from core operations, which surged by 75% to Rs 847 crore in the fourth quarter, compared to Rs 484 crore in the corresponding quarter a year prior, according to the company’s consolidated financial results.

Accompanying these impressive financial outcomes, the BSE declared a final dividend of Rs 23 per share for its shareholders.

This comprised a special dividend of Rs 5 per share celebrating the company’s 150th anniversary, along with a regular dividend of Rs 18 per share. Both dividends pertain to shares with a face value of Rs 2 each.

The company noted that the dividend proposal awaits approval from shareholders at the upcoming 20th Annual General Meeting.

The ‘Record Date’ for identifying eligible shareholders for the dividend is set for Wednesday, May 14. The BSE aims to finalize the dividend payment by Thursday, September 18, as stated in their exchange filing.

Previously, on June 14, the BSE had already issued a Rs 15 per share dividend. The latest announcement elevates the total dividend for the year to Rs 38 per share.

Notwithstanding the robust financial performance and dividend announcement, BSE shares ended 3.15% lower on Tuesday at Rs 6,250, a drop from Rs 6,453.50 in the preceding trading session.

Over the past five years, BSE shares have delivered an astonishing return of over 4,785% to investors.

In just the last year, the stock has yielded a return of 119%, illustrating strong investor confidence and consistent performance.