Will the Fed's Rate Cut Propel South Korea's Stock Market?

Synopsis

Key Takeaways

- Fed's rate cut boosts liquidity.

- Potential for foreign investment increase.

- KOSPI currently at 33% foreign ownership.

- Trade talks with the US could impact the market.

- Caution advised on short-term market fluctuations.

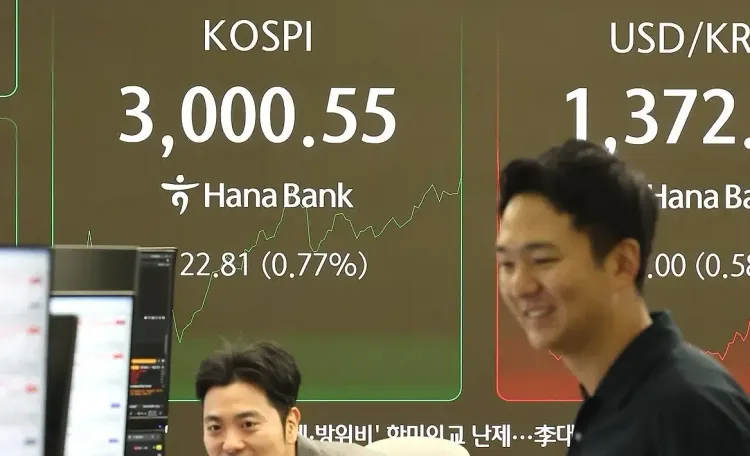

Seoul, Sep 18 (NationPress) Analysts have suggested that the recent rate reduction by the US Federal Reserve could enhance liquidity and offer a positive boost to the South Korean stock market. On Wednesday (local time), the Fed reduced its key interest rate by 25 basis points, marking the first cut since December and the inaugural reduction under President Donald Trump's administration, as reported by Yonhap news agency.

This move also hinted at the potential for two more rate cuts this year, driven by increasing political and economic pressures to stimulate growth.

According to Lee Kyoung-min, an analyst from Daishin Securities, "This is anticipated to bolster liquidity momentum and foster hopes for an economic recovery."

Similarly, Na Jeong-hwan from NH Investment & Securities predicts that this latest rate adjustment could attract more capital from foreign investors.

"Foreign ownership in the KOSPI has bounced back to 33 percent, although this is still below pre-COVID-19 levels of around 35 to 39 percent," Na explained.

Han Ji-young from Kiwoon Securities expressed optimism that the KOSPI will maintain a bullish trend until the year's end, but cautioned about potential short-term fluctuations as investors analyze the Federal Open Market Committee's decisions.

Trade negotiations with Washington are another crucial element that could influence the trajectory of the local stock market, according to Hwang Jun-ho from SangSangIn Investment & Securities. He noted that a prolonged stalemate in tariff discussions with the U.S., compared to other economies like Japan and the European Union, could weaken the price competitiveness of South Korea's key exports, placing additional downward pressure on the KOSPI.

"If tariff talks do not reach a successful conclusion, it could undermine the government's attempts to support the stock market, leading to declines in sectors such as semiconductors and biotech, which are expected to drive the KOSPI's growth," he cautioned.