Is SEBI Collaborating with UIDAI and RBI for Remote KYC Access for NRIs?

Synopsis

Key Takeaways

- Secure remote KYC access for NRIs is being prioritized by SEBI.

- Collaboration with UIDAI and RBI is in progress.

- SEBI is shifting to predictive oversight for better market regulation.

- New technology will help detect fraudulent trading patterns.

- A safety net for depository participants is being considered.

Mumbai, Oct 12 (NationPress) The Securities and Exchange Board of India (SEBI) is currently engaged in advanced discussions with the UIDAI and the RBI to facilitate secure, remote KYC access for non-resident Indians (NRIs), which is presently undergoing testing.

As per SEBI Chairman Tuhin Kanta Pandey, achieving this will be a top priority to ensure NRIs do not need to travel to India for KYC.

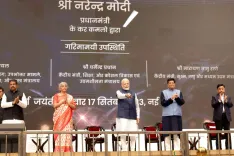

“This will represent a significant advancement once it is operational,” Pandey mentioned during an event hosted by the BSE Brokers Forum (BBF) in Mumbai.

On the regulatory oversight front, he stated, “we are transitioning from reactive supervision to predictive oversight.”

“We have overhauled our data warehouse system to create new rule-based alerts aimed at identifying pump-and-dump schemes and detecting fraudulent trades in bulk deals,” the SEBI Chairman shared with attendees.

Pandey also indicated that pump-and-dump schemes exhibit recognizable patterns, as evidenced in SEBI orders, and the new technology will assist in monitoring such manipulative actions using data-driven insights.

Furthermore, SEBI is developing a safety net mechanism for depository participants (DPs).

“We are exploring the implementation of a safety net so that in the event of an outage at a depository participant, the issue can be resolved at the depositories’ end—similar to existing measures for stock brokers,” he added.

The SEBI Chairman noted that numerous regulatory initiatives have already been activated following extensive data analysis.

Regarding foreign portfolio investor (FPI) registration, he mentioned SEBI's intent to further simplify the process.

“FPI registration is a gateway to the global market, and if this gateway is obstructed, it will not shine in its entirety. This is not merely about risk; it’s about recognizing and resolving operational challenges,” he emphasized. Pandey reiterated that safeguarding investors from cyber fraud and deceptive advice from unregistered financial influencers remains a crucial focus for SEBI.

Previously, during a panel discussion at the Global Fintech Fest (GFF) 2025 last week, Pandey highlighted various technology-driven initiatives, such as the Investor Risk Reduction Access Platform and a Unified Investor App, which have bolstered investor protection and market efficiency.

This has resulted in consolidated access to holdings, transaction history, e-voting, and proxy advisory recommendations. “Grievance resolutions have also been streamlined through Digital Locker and an enhanced SEBI Complaints Redressal System (SCORES),” the SEBI Chairman concluded.