Is Pakistan’s GDP Growth Rate Falling Below IMF Estimates?

Synopsis

Key Takeaways

- Exports have decreased significantly, impacting GDP.

- Flooding has caused severe damage to agriculture.

- GDP growth rate is projected to drop below IMF estimates.

- Unemployment may rise by 1.2 percentage points.

- Inflation trends show rising prices for essential commodities.

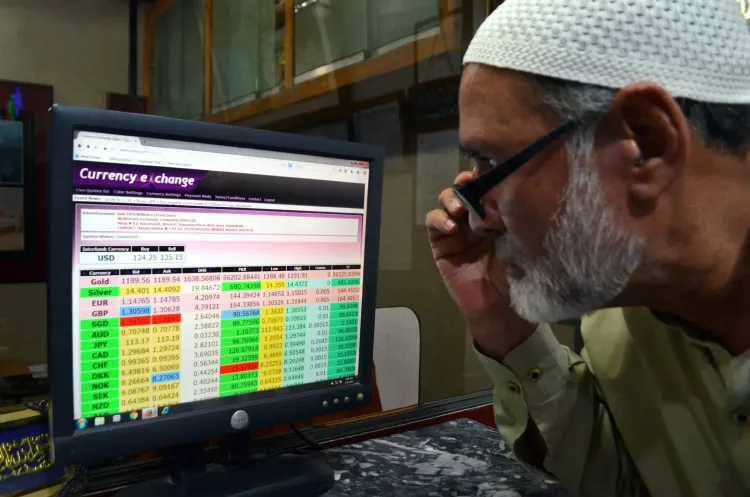

New Delhi, Jan 7 (NationPress) The significant drop in Pakistan's exports, coupled with the adverse effects of flooding on the agricultural sector, is anticipated to lower the nation’s growth rate below the IMF’s projections, as highlighted in a recent article from Pakistani media.

The piece in the Business Recorder by prominent economist Hafiz Pasha notes that exports fell sharply by 14.5% in November 2025 and 6.2% in the initial five-month period. Notably, rice exports have plummeted by 49%, with volumes decreasing by 40%, indicating that the decline in rice production may be more pronounced than previously thought. Additionally, textile exports have seen minimal growth.

These trends suggest that the GDP growth rate expectations set by the Planning Commission and the IMF are overly optimistic. A more realistic forecast for the GDP growth rate in 2025-26 is around 3%, which could lead to an increase in unemployment by 1.2 percentage points, potentially affecting nearly 1 million individuals, as stated in the article.

The IMF’s estimate for the GDP growth rate in 2025-26 stands at 3.2%, a reduction from the earlier 3.6% due to the ongoing repercussions of the floods.

The annual plan anticipates gross fixed capital formation in Pakistan to grow to 13% of the GDP from 12% in 2024-25, primarily driven by private investment.

The IMF also forecasts fixed investment to exceed 13% of the GDP, while government investment is projected to decrease by 0.2% of the GDP.

The article indicates that outstanding bank credit to the private sector saw a slight decline of 2% since November 2024, despite lower interest rates. However, this reduction in private sector credit does not align with machinery imports, which have surged by 13.5%, excluding power-generating machinery.

Moreover, development expenditure by federal and provincial governments has only increased by 6%, remaining below 0.3% of GDP in the first quarter of 2025-26.

Overall, the target for gross fixed capital formation of 13% of GDP may prove challenging, potentially settling closer to 12.5%, particularly due to significant shortfalls in tax revenues.

The article further notes that the first months of 2025-26 have shown a slight uptick in the inflation rate, rising from 4.1% in July to 5.6% in December 2025. The average rate has hovered around 5%, 0.5 percentage points higher than last year. Prices for wheat, flour, sugar, gas, and fresh fruits have surged by over 20%. Conversely, prices for pulses, potatoes, tea, and electricity have significantly declined.

Despite the significant rise in inflation in Pakistan, international prices have displayed a noticeable downward trend. The World Bank International Commodity Price Index has dropped by nearly 7% from July to September 2025, compared to the same period in 2024.