Is Congress Right to Slam PM Modi Over GST Reforms?

Synopsis

Key Takeaways

- Congress criticizes PM Modi's GST reforms as inadequate.

- MSMEs continue to face significant hurdles.

- Calls for a comprehensive GST overhaul, referred to as GST 2.0.

- Trade deficit with China has reached alarming levels.

- Concerns raised about the effectiveness of the reforms on GDP growth.

New Delhi, Sep 21 (NationPress) Shortly after Prime Minister Narendra Modi's national address on Sunday evening regarding significant reforms in the Goods and Services Tax (GST) framework, the Congress party responded sharply, labeling the modifications as “inadequate” and accusing the Prime Minister of taking sole credit for decisions made by the GST Council—a constitutional body.

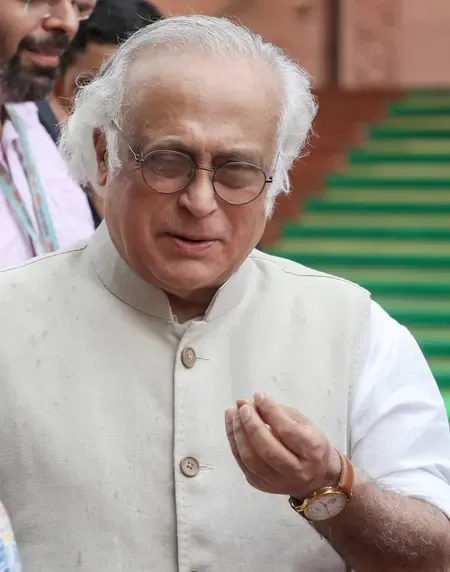

Jairam Ramesh, Congress General Secretary overseeing Communications, stated in a post on X, “The Prime Minister addressed the nation today to claim sole ownership of the amendments made to the GST regime by the GST Council, a constitutional body.”

Ramesh reaffirmed that the Congress has consistently referred to GST as a “Growth Suppressing Tax” burdened with “multiple tax brackets, punitive rates on mass consumption items, widespread evasion, costly compliance, and an inverted duty structure.”

He mentioned that the party has been advocating for a “GST 2.0” since July 2017, a promise reiterated in its 2024 Lok Sabha election manifesto, the Nyay Patra.

Highlighting the inadequacies of the reforms, Ramesh pointed out that MSMEs, which are crucial for employment generation in India, continue to encounter procedural obstacles, and the thresholds for interstate supplies require further adjustments.

He also raised concerns about unresolved issues in textiles, tourism, handicrafts, exports, and agricultural inputs, and urged that states be encouraged to include electricity, petroleum, alcohol, and real estate under the GST framework.

Ramesh criticized the government for not extending the GST compensation period for another five years, a longstanding request from the states, “in the true spirit of cooperative federalism.”

“Whether this round of GST changes—delayed by 8 years—will truly stimulate the private investment necessary for increased GDP growth remains uncertain,” Ramesh commented.

“In the meantime, the trade deficit with China has doubled over the past five years, surpassing $100 billion. Furthermore, Indian businesses are suffocated by fear and oligopolization, leading many entrepreneurs to relocate abroad,” he added.

These remarks from the Congress leader followed PM Modi's call to celebrate a “GST Bachhat Utsav” during Navratri, framing the reforms as a significant relief for consumers and a step towards economic progress.