Did RBI Just Double the IPO Loan Limit to Rs 25 Lakh?

Synopsis

Key Takeaways

- IPO loan limit increased to Rs 25 lakh.

- Effective from October 1, 2024.

- Encourages HNI participation in public offerings.

- Removal of the lending cap on listed debt securities.

- Support for infrastructure projects through lower risk weights.

Mumbai, Oct 1 (NationPress) The Reserve Bank of India (RBI) unveiled significant changes on Wednesday to facilitate easier access to bank credit for both businesses and individuals.

The central bank has permitted banks to finance acquisitions by Indian corporations while also relaxing the rules governing lending against shares and debt securities.

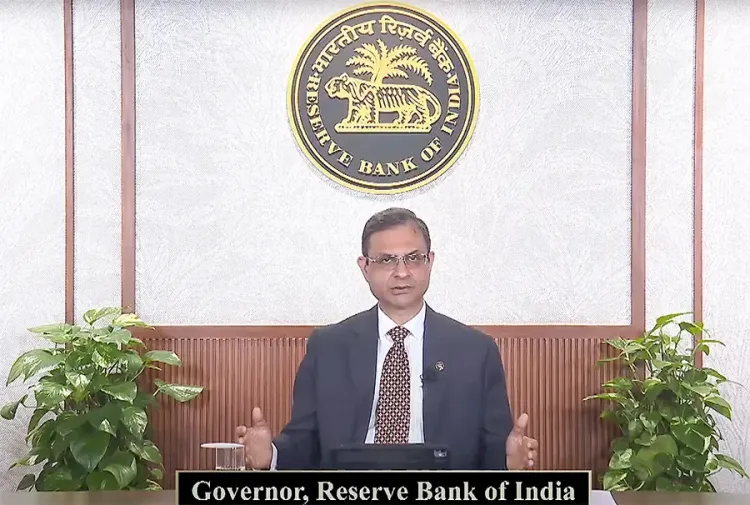

After the conclusion of the Monetary Policy Committee (MPC) meeting, Governor Sanjay Malhotra stated that the RBI would establish a supportive framework to enable banks to provide loans for acquisitions.

This initiative follows a request from the State Bank of India to the regulator to permit such financing.

Malhotra further indicated that the central bank has eliminated the regulatory cap on lending against listed debt securities.

Additionally, the lending limit against shares has been increased from Rs 20 lakh to Rs 1 crore per individual.

For financing Initial Public Offerings (IPOs), the limit has been elevated from Rs 10 lakh to Rs 25 lakh per investor.

This adjustment, effective from October 1, 2024, is particularly advantageous for high net worth individuals (HNIs) seeking to invest larger sums in public offerings.

The RBI has also resolved to lower the cost of lending for infrastructure projects by reducing risk weights on loans provided by non-banking financial companies (NBFCs) for top-tier infrastructure ventures.

Simultaneously, the regulator has rescinded a 2016 regulation that had dissuaded lending to large borrowers with bank exposure exceeding Rs 10,000 crore. This is anticipated to enhance the overall availability of credit within the financial system.

Regarding regulatory timelines, Malhotra mentioned that the expected credit loss (ECL) framework and the Basel 3 capital framework will be implemented in 2027, allowing banks ample time for necessary adjustments.

Experts have indicated that the RBI's recent decisions are designed to promote increased lending by banks, support corporate acquisitions, enhance IPO engagement, and facilitate easier access to funds for infrastructure and business development.