How Do MPC Decisions Enhance Credit Flow and Foster Inclusive Growth?

Synopsis

Key Takeaways

- Repo rate maintained at 5.5%

- Neutral stance fosters balanced growth

- GDP growth projection raised to 6.8%

- Enhanced credit flow expected in the market

- Focus on digital banking services for consumers

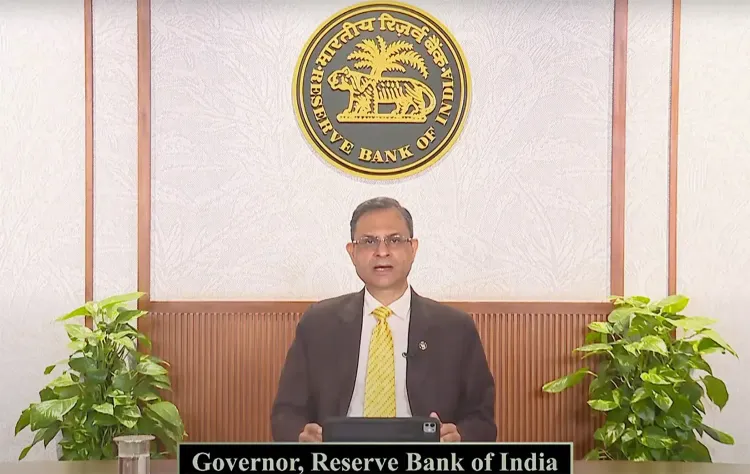

New Delhi, Oct 1 (NationPress) Bank officials expressed their approval of the Reserve Bank of India’s (RBI) decision to keep the repo rate steady at 5.5 percent while maintaining a neutral stance. This decision is seen as a reflection of a well-balanced strategy aimed at fostering growth while ensuring price stability.

A neutral stance implies a position that neither stimulates nor restricts liquidity, effectively balancing the need to control inflation without adversely impacting growth.

Binod Kumar, Managing Director and CEO of Indian Bank, noted that the RBI MPC's consistent policy enhances predictability for clients, resulting in stable EMIs and timely credit access, which supports current consumption plans.

“This consistency, along with reduced risk weight on MSMEs and residential real estate, is likely to stimulate demand in these sectors. This aligns with broader economic goals, including the ongoing initiatives to internationalize the Rupee and advance India’s path towards becoming a developed nation,” he stated.

The RBI also increased its forecast for India’s GDP growth rate to 6.8 percent for 2025-26, up from the previous estimate of 6.5 percent.

Ajay Kumar Srivastava, the Managing Director and CEO of Indian Overseas Bank, remarked that with inflation under control, aided by declining food prices and GST adjustments, the upward revision of GDP growth to 6.68 percent for FY26 reflects the resilience of the Indian economy amidst global uncertainties.

“For the banking industry, initiatives aimed at regulatory changes such as proposed risk-based deposit insurance premiums, the easing of risk weights for MSME and residential real estate lending, and frameworks for corporate acquisitions and capital market financing are anticipated to further enhance credit flow in the market and encourage inclusive growth,” Srivastava added.

Moreover, expanding the range of services for basic bank savings accounts through mobile and internet platforms is expected to positively impact consumers, he concluded.

According to Rajosik Banerjee, Partner and Deputy Head of Risk Advisory, and Head - Financial Risk Management at KPMG India, the RBI’s monetary policy outlines significant measures aimed at strengthening the resilience and competitiveness of Indian banks.

This includes the much-anticipated issuance of the Expected Credit Loss (ECL) framework applicable to all Scheduled Commercial Banks (excluding Small Finance Banks (SFBs), Payment Banks (PBs), Regional Rural Banks (RRBs), and All India Financial Institutions (AIFIs)) effective from April 1, 2027, with a gradual implementation period until March 31, 2031 to mitigate the one-time impact of increased provisioning.

“Furthermore, there is a movement towards revised 'Basel III' capital adequacy norms set to take effect in April 2027, alongside a shift towards the 'Standardized Approach for Credit Risk', proposing lower risk weights on specific segments to reduce overall capital requirements,” Banerjee explained.